API guide

Important: We strongly recommend that all new integrations use the new ePayment API.

The Vipps eCom API is used by Vipps på nett (Vipps Online), Vipps Checkout, Vipps i kassa (Vipps in Store), native apps and other solutions.

API version: 2.0.0.

Payment flows

There are many ways to use the Vipps eCom API. For example:

- Vipps Online (aka Vipps på nett) - The customer selects Vipps as the method of payment and enters their mobile number into the app or website. The merchant initiates the payment command. The customer confirms the purchase through their Vipps app. If the purchase is approved, the merchant registers the sale in their system. See eCommerce API: How It Works for more information.

- Vipps Express Checkout (aka Vipps Hurtigkasse) - The same as Vipps Online except that the shipping address and package delivery options that are selected in the Vipps app.

- Vipps Checkout - The same as Vipps Online except that, instead of confirming the purchase in the Vipps app, the customer consents to sharing their personal information (e.g., address, phone, and payment information). They then complete the purchase from the website where their information is automatically pre-filled.

- Vipps In Store (aka Vipps i kassa) - The same as Vipps Online except that the phone number is provided to the service provider who then initiates the payment through their Point of Sale (POS) system. See eCommerce API: How it works in the store for more information.

This diagram shows a simplified payment flow:

See Get payment details for more information about the detailed flow and Payment states for the corresponding states.

The flow of settlements and how to retrieve them are described in Settlements.

Quick start

The normal "happy day" flow for a payment is documented in the Quick start guide.

This API guide is extensive: We have done our best to document everything about this API, and you should have all information needed to integrate with Vipps.

API endpoints

The Vipps eCommerce API (eCom API) offers functionality for online payments. Payments are supported in both web browsers and in native apps (via deep-linking).

| Operation | Description | Endpoint |

|---|---|---|

| Initiate payment | Payment initiation, the first request in the payment flow. This reserves an amount. | POST:/ecomm/v2/payments |

| Capture payment | When an amount has been reserved, and the goods are (about to be) shipped, the payment must be captured. | POST:/ecomm/v2/payments/{orderId}/capture |

| Cancel payment | The merchant may cancel a reserved amount, but not on a captured amount. | PUT:/ecomm/v2/payments/{orderId}/cancel |

| Refund payment | The merchant may refund a captured amount. | POST:/ecomm/v2/payments/{orderId}/refund |

| Get payment details | The full history of the payment. | GET:/ecomm/v2/payments/{orderId}/details |

| Get order status | Deprecated, use Get payment details. | Deprecated, use GET:/ecomm/v2/payments/{orderId}/details |

Necessary endpoint from other APIs:

| Operation | Description | Endpoint |

|---|---|---|

| Get Access token | Fetch the access token | POST:/accesstoken/get |

See the eCom API checklist.

Vipps HTTP headers

We recommend using the standard Vipps HTTP headers for all requests.

See Vipps HTTP headers in the Common topics guide, for details.

Authentication

All Vipps API calls are authenticated with an access token and an API subscription key. See Get an access token in the Getting started guide, for details.

Initiate

Payment amounts must be in NOK, be non-zero and larger than 1 NOK (1 NOK = 100 øre).

Amounts are specified in minor units. For Norwegian kroner (NOK) that means 1 kr = 100 øre. Example: 499 kr = 49900 øre.

When you initiate a payment, it will normally only be reserved until you capture it.

This has some benefits:

- If a payment has been reserved, the merchant can

make a

PUT:/ecomm/v2/payments/acme-shop-123-order123abc/cancelcall to immediately release the reservation. - It is possible to reserve a higher amount and only capture a part of it (useful for electric car charging stations, etc.). It is also possible to capture the full amount with multiple captures ("partial capture").

See:

- Reserve and capture

- When should I charge the customer.

- What is the difference between "Reserve Capture" and "Direct Capture"?

- When should I use "Direct Capture"?

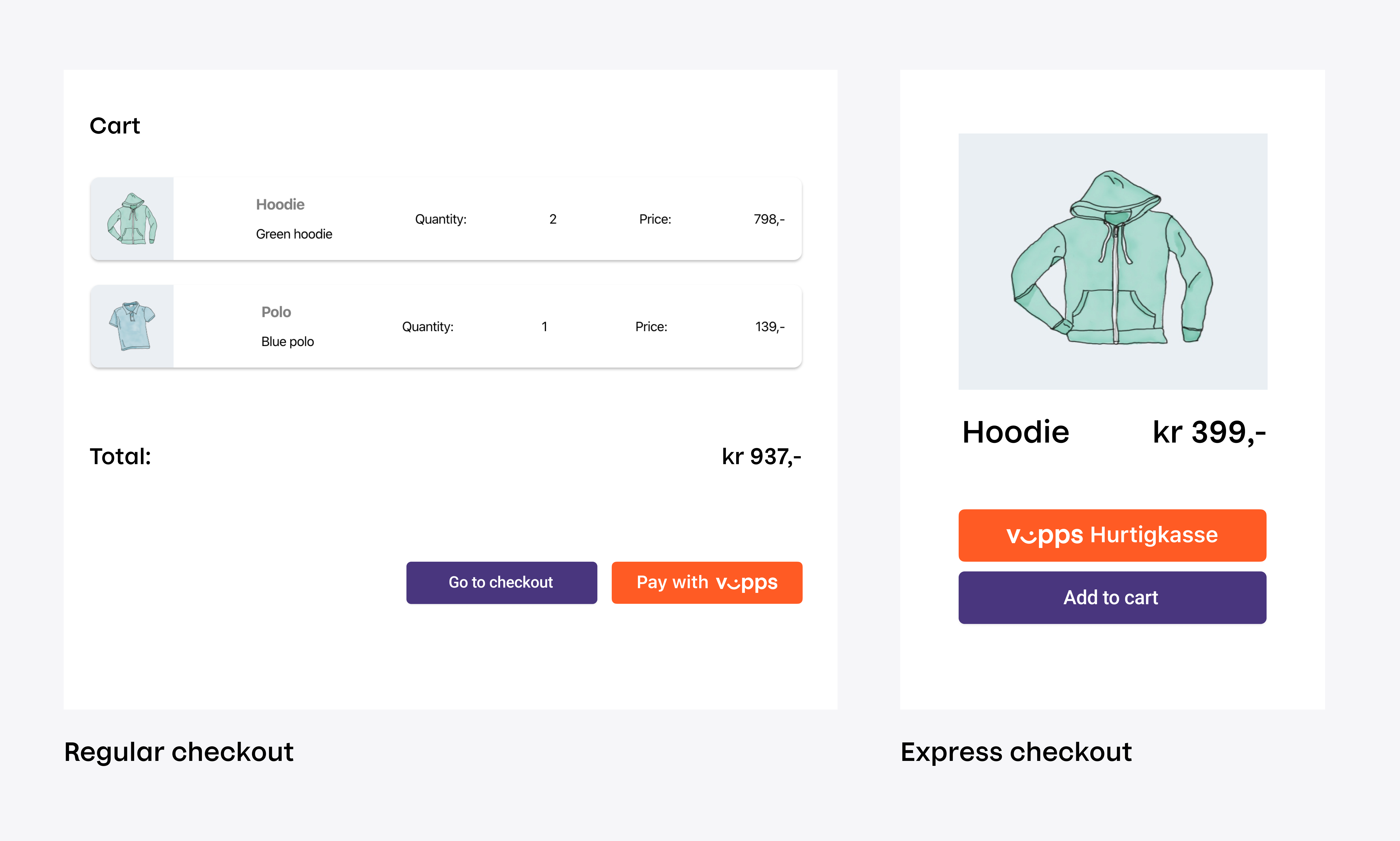

Regular payments and express payments

Vipps eCommerce API offers two types of payments:

- Regular eCommerce payments

- Express checkout payments

Examples from a demo website:

Regular eCommerce payments

This is the typical flow, where the user adds items to a shopping cart, enters the shipping address and pays.

See:

Express checkout payments

The Express checkout (Vipps Hurtigkasse) is a solution for letting the user automatically share the address information with merchant and choose a shipping option.

Express checkout is designed for shipping products, with a delivery address and a shipping method.

Please note: If you only need the user's information, you should use Userinfo. You should avoid asking the customer in a pub for the shipping method for the drinks, etc.

Vipps Hurtigkasse works this way, as seen from the user's side:

- The user clicks the "Vipps Hurtigkasse" button.

- The user consents to sharing address information in Vipps.

- The user confirms the amount, delivery address and delivery method in Vipps.

To perform an express checkout, the merchant needs to specify

"paymentType": "eComm Express Payment" in the

POST:/ecomm/v2/payments

call, and support the

POST:[shippingDetailsPrefix]/v2/payments/{orderId}/shippingDetails

and

DELETE:/v2/consents/{userId}

endpoints.

Shipping and static shipping details

The shipping methods presented to the user in Vipps are fetched from the merchant's

POST:[shippingDetailsPrefix]/v2/payments/{orderId}/shippingDetails

endpoint.

If the shipping methods and cost can be known in advance, the staticShippingDetails field in

POST:/ecomm/v2/payments

may be used to provide the shipping details up front, and thereby avoid an

extra round-trip between the Vipps backend and the merchant's server.

When using staticShippingDetails the shipping costs for the available

shipping methods are then sent directly, eliminating the need for the user to

first select shipping method and then for the merchant to calculate the cost for it.

We recommend using staticShippingDetails if possible, as it gives a faster

payment process and a better user experience. It also eliminates timeout problems

caused by delays in the merchant's or shipping partner's calculations of cost.

Consent and GDPR

Vipps complies with GDPR, and requires the user's consent before any information

is shared with the merchant. The merchant must provide a URL (consentRemovalPrefix)

that Vipps can call to delete the data. Vipps allows the user to later

remove this consent (via the Profile -> Security -> "Access to your information"

-> "Companies that remember you" screens).

The personal information shared with the merchant is available for 7 days after reservation.

After this, all customer information will be replaced with "[Expired]" in subsequent calls to

GET:/ecomm/v2/payments/{orderId}/details.

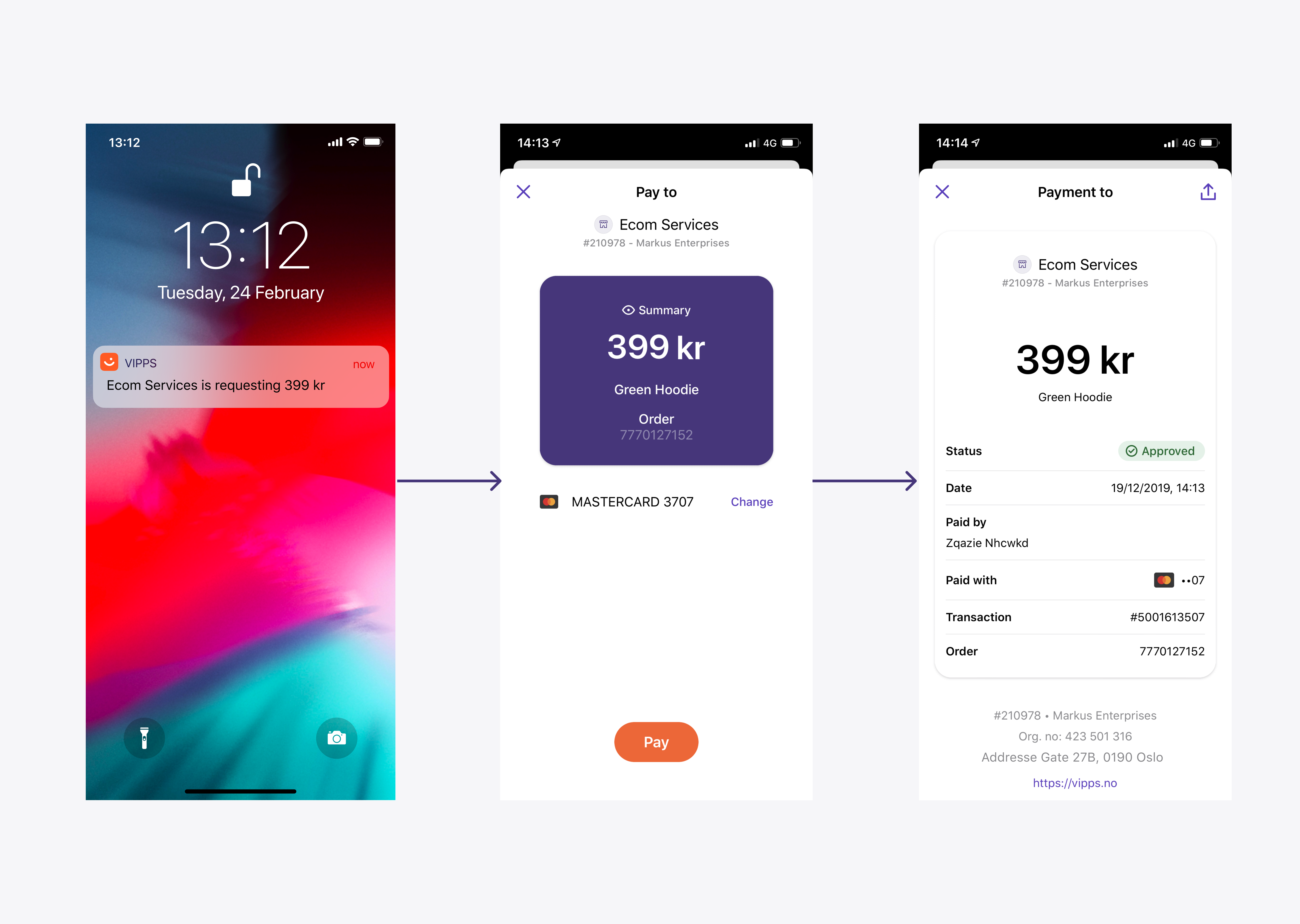

Phone and mobile browser flow

A payment is initiated with a call to

POST:/ecomm/v2/payments.

Triggered by the payment initiation, the landing page will automatically detect if it is being invoked on a phone, and whether Vipps is installed on the phone. If Vipps is installed, Vipps will automatically be opened.

Vipps installed

- Vipps is invoked (with app-switch).

- The user accepts or rejects the payment request in Vipps.

- The Vipps backend makes a call to the merchant's

callbackPrefixwith information about the payment. - Once payment process is completed, Vipps redirects to the

fallBackURL that merchant provided earlier (see above).

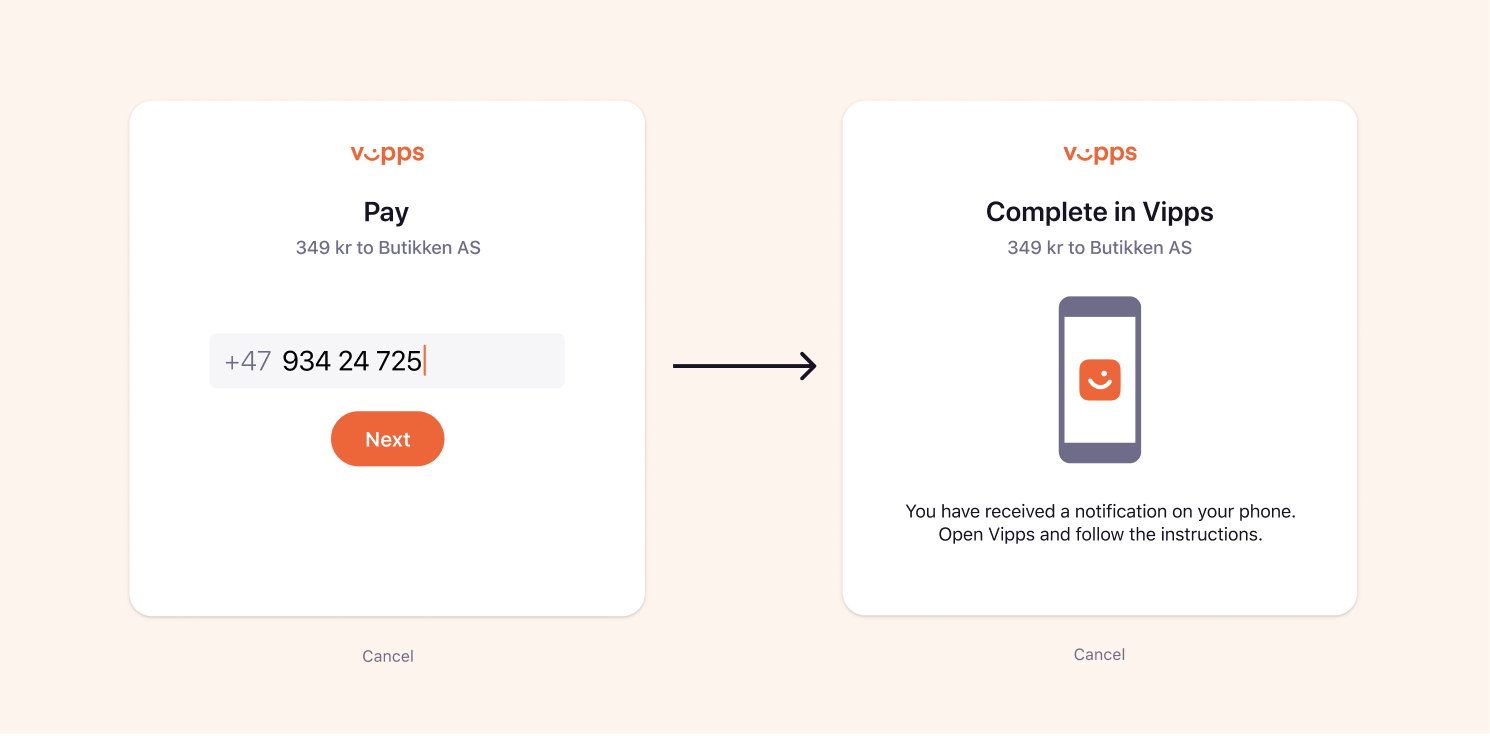

Vipps not installed

- The landing page (in the browser) prompts the user for the phone number.

- The Vipps backend sends a push notification to the user's phone, and also displays a notification on the landing page for the user to continue the payment in Vipps on the phone.

- The user accepts or rejects the payment in Vipps.

- The Vipps backend makes a call to the merchant's

callbackPrefixwith information about the payment. - Once the payment process is completed, Vipps redirects to the

fallBackURL that the merchant provided earlier.

Please note:

- Vipps cannot guarantee that the user will get to the

fallBackURL, since the user may switch away from Vipps or "kill" the app, or there may be network or battery problems, etc. before the URL is opened. If the merchant relies 100 % on users visiting thefallbackURL, there will be problems: The user has completed the payment, but the merchant ignores it. - If the user has started the payment in an embedded browser, such as in

Facebook or Instagram, it is not possible for Vipps to open the

fallBackURL in the embedded browser. The phone OS will always open URLs in the default browser. See: Common topics: Recommendations regarding handling redirects. - Because of the above, a successful payment must not rely on session cookies in the browser.

- Vipps cannot guarantee a particular sequence of callback and fallback, as this depends on user actions, network connectivity/speed, etc. Because of this, it is not possible to base an integration on a specific sequence of events.

- URLs must be valid. See: URL validation

Desktop flow

- The landing page will be opened in the desktop browser.

- The landing page will prompt for the user’s phone number. If the phone number is known, it should be pre-filled by the merchant.

- Vipps sends a push notification the user's phone, with a notification on the landing page to continue the payment in Vipps on the phone.

- The user accepts or rejects the payment in Vipps.

- The Vipps backend makes a call to the merchant's

callbackPrefixwith information about the payment. See: Callbacks. - Once the payment process is completed, the landing page will redirect to the

fallBackURL that merchant provided earlier (see above).

Payments initiated in an app

If payments are always initiated in the merchant's native app, there is no need to pass any additional parameters. Vipps will handle everything automatically.

It is possible to send the optional isApp parameter, which comes with some

additional responsibility.

See:

Initiate payment flow: API calls

API Specification:

POST:/ecomm/v2/payments

A minimal example:

{

"customerInfo": {},

"merchantInfo": {

"merchantSerialNumber": "123456",

"callbackPrefix": "https://example.com/vipps/callbacks-for-payment-update-from-vipps",

"fallBack": "https://example.com/vipps/fallback-result-page-for-both-success-and-failure/acme-shop-123-order123abc"

},

"transaction": {

"orderId": "acme-shop-123-order123abc",

"amount": 20000,

"transactionText": "One pair of Vipps socks"

}

}

An express payment example with more parameters provided:

{

"customerInfo": {

"mobileNumber": "48059528"

},

"merchantInfo": {

"authToken": "eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1Ni <snip>",

"callbackPrefix": "https://example.com/vipps/callbacks-for-payment-update-from-vipps",

"consentRemovalPrefix": "https://example.com/vipps/consents/",

"fallBack": "https://example.com/vipps/fallback-result-page-for-both-success-and-failure/acme-shop-123-order123abc",

"merchantSerialNumber": 123456,

"shippingDetailsPrefix": "https://example.com/vipps/shipping/",

"paymentType": "eComm Express Payment",

"staticShippingDetails": [

{

"isDefault": "N",

"priority": 1,

"shippingCost": 99,

"shippingMethod": "Walking",

"shippingMethodId": "123abc"

},

{

"isDefault": "Y",

"priority": 2,

"shippingCost": 199,

"shippingMethod": "Running",

"shippingMethodId": "321abc"

}

]

},

"transaction": {

"amount": 20000,

"orderId": "acme-shop-123-order123abc",

"timeStamp": "2018-12-12T11:18:38.246Z",

"transactionText": "One pair of Vipps socks"

}

}

Please note: The phone number is optional and should only be sent if it is

already known.

Users should never be asked for the phone number, as they will

either be automatically app-switched to the Vipps app, or they will be presented

with the

landing page.

If the customer's phone number is needed by the merchant: Use scope and the

Userinfo API.

Important: Do not send sensitive information in the transactionText field.

See:

- Recommendations for

paymentDescriptionandtransactionText. - Datatilsynet's information about which types of information is sensitive (in Norwegian).

The Vipps deeplink URL

Vipps responds to the

POST:/ecomm/v2/payments

request with a URL.

The URL is normally a https:// URL, which automatically opens Vipps if the

apps is installed (and the landing page, if not).

isApp

See isApp in Common topics.

Payment identification

A payment is uniquely identified by the combination of merchantSerialNumber

and orderId:

merchantSerialNumber: The merchant's Vipps ID. Example:123456.orderId: Must be unique for themerchantSerialNumber. Example:acme-shop-123-order123abc. See:orderIdrecommendations.

Payment retries

If a user cancels or does not act on a payment, there is no way to "retry" the payment.

The initiate call is not idempotent, so the closest to a "retry"

is to make a new initiate call with a new orderId. Vipps has no concept

of relation between orders, so the "retry" payment is in no way connected

to the first payment attempt.

orderId recommendations

See

orderId recommendations

in Common topics.

transactionText recommendations

See

Recommendations for paymentDescription and transactionText

in Common topics.

URL Validation

See URL Validation in Common topics.

Callbacks

Callbacks allow Vipps to send the merchant information about the payment. Callback are made for the following events:

- Payment successful

- Payment failed

- Payment rejected

- Payment timed out

Please note: Callback offer a faster user experience than polling, but you

cannot rely on callbacks alone. You must also poll

GET:/ecomm/v2/payments/{orderId}/details

as described in the

Polling guidelines in the Common topics.

Important:

- Vipps makes one attempt at a callback and cannot guarantee that it succeeds, as it depends on network, firewalls and other factors that Vipps cannot control. If the communication is broken during the process for some reason and Vipps is not able to execute callback to the merchant's server, the callback will not be retried.

- Vipps callbacks require a response within 3 seconds; otherwise, they will time out.

- Callback URLs must use HTTPS.

The callback request body is different for the different payment types:

"eComm Regular Payment": The callback contains the order and transaction details."eComm Express Payment": The callback contains the order and transaction details and in addition the user details and shipping details.- If Userinfo is used: The callback is the same as for

"eComm Express Payment".

See:

Callback URLs

The callback URLs are generated by appending the orderId to the callbackPrefix

sent in the

POST:/ecomm/v2/payments/{orderId}

call. The callbackPrefix is for an API endpoint on the merchant's side.

See the API specifications.

For example, if your callbackPrefix is https://example.com/vipps/callback and the

orderId is acme-shop-123-order123abc, Vipps will append /v2/payments/acme-shop-123-order123abc

(note the leading slash)

to https://example.com/vipps/callback and make a callback to

https://example.com/vipps/callback/v2/payments/acme-shop-123-order123abc.

Again:

callbackPrefix+/v2/payments/+{orderId}https://example.com/vipps/callback+/v2/payments/+acme-shop-123-order123abc

Important:

- URLs must be valid.

- Vipps does not support sending requests to all ports, so to be safe use common port numbers such as: 80, 443, 8080.

- Vipps does not support callback URLs that return

HTTP 301 Redirect,HTTP 302 Permanently MovedorHTTP 307 Temporary Redirect. Vipps will not follow to aLocation. The callback URLs must be directly reachable.

Callback examples

Below are two examples of payment update callbacks with

POST:[callbackPrefix]/v2/payments/{orderId}.

Example: "eComm Regular Payment" callback:

{

"merchantSerialNumber": 123456,

"orderId": "acme-shop-123-order123abc",

"transactionInfo": {

"amount": 20000,

"status": "RESERVED",

"timeStamp": "2018-12-12T11:18:38.246Z",

"transactionId": "5001420062"

}

}

Example: "eComm Express Payment" callback:

{

"merchantSerialNumber": 123456,

"orderId": "acme-shop-123-order123abc",

"shippingDetails": {

"address": {

"addressLine1": "Dronning Eufemias gate 42",

"addressLine2": "Att: Rune Garborg",

"city": "OSLO",

"country": "NO",

"zipCode": "0191" // Postcode (apologies for not using postCode as elsewhere)

},

"shippingCost": 99,

"shippingMethod": "By cannon",

"shippingMethodId": "53DBB6BA-89DB-4997-B444-5E9F1681E3D3"

},

"transactionInfo": {

"amount": 20000,

"status": "RESERVE",

"timeStamp": "2018-12-12T11:18:38.246Z",

"transactionId": "5001420062"

},

"userDetails": {

"firstName": "Ada",

"lastName": "Lovelace",

"email": "user@example.com",

"mobileNumber": "12345678",

"userId": "1234567"

}

}

Please note: Regular payments use RESERVED, but express payments use

RESERVE. We apologize for this, but it is technical debt, and it cannot be

corrected in this version of the API, as that would break backwards compatibility.

How to test your own callbacks

We recommend using HTTPie for testing your callbacks.

Create a JSON file with the callback request payload based on the example for

POST:[callbackPrefix]/v2/payments/{orderId}:{

"merchantSerialNumber": 123456,

"orderId": "acme-shop-123-order123abc",

"transactionInfo": {

"amount": 20000,

"status": "RESERVED",

"timeStamp": "2018-12-12T11:18:38.246Z",

"transactionId": "5001420062"

}

}Save this JSON file as

callback.json.Build your callback URL. In this example, the

callbackPrefixishttps://example.com/vipps/callback, and theorderIdisacme-shop-123-order123abc.Test the callback by making a POST request to your callback URL with the JSON file as request body:

http POST https://example.com/vipps/callback/v2/payments/acme-shop-123-order123abc < callback.jsonIf it does not return

HTTP 200 OK, your callback handling does not work, and you must correct it.

We recommend checking callbacks on the API Dashboard.

Authorization for callbacks

If you provide the authToken when initiating a payment with

POST:/ecomm/v2/payments/{orderId},

the authToken will be sent as an Authorization header in the callback and

shipping details requests. Please note that this is unrelated to the

authentication

required by the Vipps API.

API spec:

POST:[callbackPrefix]/v2/payments/{orderId}

Vipps callback servers

The callbacks from Vipps are made from the servers described in Vipps request servers.

Please make sure that requests from these servers are allowed through firewalls, etc.

Callback statuses

These are the statuses provided by Vipps in the callbacks by

[callbackPrefix]/v2/payments/{orderId}:

| Callback type | Response | Description |

|---|---|---|

| Regular checkout | RESERVED | Payment reserved by user accepting the payment in Vipps. |

SALE | Payment captured with direct capture by merchant (after RESERVED). | |

RESERVE_FAILED | Reserve capture failed because of insufficient funds, invalid card or similar. | |

SALE_FAILED | Direct capture failed because of insufficient funds, invalid card or similar. | |

CANCELLED | Payment cancelled by the user in Vipps. | |

REJECTED | User did not act on the payment (timeout, etc.). | |

| Express checkout | RESERVE | Payment reserved by user accepting the payment in Vipps (it is correct that this is different from RESERVED for regular checkout - sorry.) |

SALE | Payment captured with direct capture, by merchant (after RESERVE). | |

RESERVE_FAILED | Reserve failed because of insufficient funds, invalid card or similar. | |

SALE_FAILED | Direct failed because of insufficient funds, invalid card or similar. | |

CANCELLED | Payment cancelled by user in Vipps. | |

REJECTED | User did not act on the payment (timeout, etc.). |

For a full history of a payment, use

[callbackPrefix]/v2/payments/{orderId}/details.

See Get payment details for more information.

Timeouts

See: Common topics: Timeouts.

Express checkout API endpoints required on the merchant side

The below endpoints are provided by the merchant and consumed by Vipps during express checkout payments. These endpoints are not required when using regular checkout.

These endpoints are to be implemented by merchants in order for Vipps to make calls to them. The documentation is included in the API specification for reference only - these endpoints are not callable at Vipps.

| Operation | Description | Endpoint |

|---|---|---|

| Get shipping details | Used to fetch shipping information, 10-second timeout | POST:/v2/payments/{orderId}/shippingDetails |

| Transaction Update | A callback to the merchant for receiving post-payment information. | POST:/v2/payments/{orderId} |

| Remove user consent | Used to inform merchant when the Vipps user removes consent to share information. | DELETE:/v2/consents/{userId} |

Please note that if the shipping details are static (i.e., do not vary based on the

address), the parameter staticShippingDetails can be used in the initiate call.

Then, there is no need to implement

POST:/v2/payments/{orderId}/shippingDetails.

See Initiate payment flow: API calls for details.

Get shipping details

The

POST:[shippingDetailsPrefix]/v2/payments/{orderId}/shippingDetails

API endpoint on the merchant's side allows Vipps to get the shipping cost and

method based on the provided address and product details.

This endpoint is required for express checkout.

Request:

{

"addressId": 3960,

"addressLine1": "Dronning Eufemias gate 42",

"addressLine2": null,

"country": "Norway",

"city": "OSLO",

"postCode": "0191",

"addressType": "H"

}

Response:

{

"addressId": 3960,

"orderId": "123456abc",

"shippingDetails": [

{

"isDefault": "N",

"priority": 1,

"shippingCost": 99,

"shippingMethod": "Walking",

"shippingMethodId": "123abc"

},

{

"isDefault": "Y",

"priority": 2,

"shippingCost": 199,

"shippingMethod": "Running",

"shippingMethodId": "321abc"

}

]

}

Payment update

See Callbacks.

Remove User Consent

The

DELETE:[consentRemovalPrefix]/v2/consents/{userId}

API endpoint on the merchant's side allows Vipps to send an end user's consent

removal request to the merchant.

This endpoint is required for express checkout.

When receiving this request,

the merchant is obliged to handle the user details as per the GDPR guidelines.

The request path will include a userId that Vipps will have provided as

part of callback and also made accessible through GET:/ecomm/v2/payments/{orderId}/details.

The landing page

When a user is directed to the url sent in the response to

POST:/ecomm/v2/payments,

they will either be taken to Vipps or to the landing page.

See Landing page from Common topics, for more details about the landing page.

Reserve

When the user confirms the purchase in Vipps, the payment status changes to RESERVE.

The respective amount will be reserved for future capturing.

For more details, see Common topics: Reserve and capture.

Capture

Capture is done with

POST:/ecomm/v2/payments/{orderId}/capture.

Use the idempotency key, X-Request-Id, in the capture call. Then, if a capture

request fails for any reason, it can be retried with the same idempotency key.

You can use any unique ID for your X-Request-Id.

See the X-Request-Id in the capturePaymentUsingPOST specification for details.

To perform a normal capture of the entire amount, amount can be

omitted from the API request (i.e., not sent at all), set to null or set to 0.

When doing a

partial capture,

you need to specify the amount.

Please note: It is important to check the response of the /capture

call. The capture is only successful when the response is HTTP 200 OK.

Capture can be made up to 180 days after reservation.

Attempting to capture an older payment will result in a

HTTP 400 Bad Request.

See the FAQ:

- When should I charge the customer.

- What is the difference between "Reserve Capture" and "Direct Capture"?

- When should I use "Direct Capture"?

See Common topics: capture for more details about the types of captures.

Cancel

The Cancel request allows the merchant to cancel a reserved or initiated transaction.

Please note that it is not possible to cancel a request that is over 180 days old.

Attempting to cancel an older payment will result in a HTTP 400 Bad Request.

The payment flow can be aborted under certain circumstances:

- When the user cancels (rejects) the initiated payment in Vipps.

- When the merchant cancels.

- Timeouts: If the user does not confirm, etc.

After cancellation, the order gets a new status:

- If an order is cancelled by the merchant while it's in the

RESERVEstate, the status becomesVOID. - If an order is cancelled by the merchant while it's in the

INITIATEstate, the status becomesCANCEL. - If an order is cancelled by the user, the status becomes

CANCEL.

Example Request:

PUT:/ecomm/v2/payments/acme-shop-123-order123abc/cancel

{

"merchantInfo": {

"merchantSerialNumber": "123456"

},

"transaction": {

"transactionText": "No socks for you!"

}

}

Response:

{

"orderId": "acme-shop-123-order123abc",

"transactionInfo": {

"amount": 20000,

"transactionText": "No socks for you!",

"status": "Cancelled",

"transactionId": "5001420063",

"timeStamp": "2018-11-14T15:31:10.004Z"

},

"transactionSummary": {

"capturedAmount": 0,

"remainingAmountToCapture": 0,

"refundedAmount": 0,

"remainingAmountToRefund": 0

}

}

Cancelling a pending order

If you wish to cancel a transaction before the customer can confirm the payment

in Vipps, you can send a

PUT:/ecomm/v2/payments/{orderId}/cancel

request while the transaction is in the INITIATE stage.

This may be useful in face-to-face situations where a customer's phone runs out

of battery, or if the customer suddenly changes their mind and wants to buy

more and the amount for the payment increases.

This should not be considered a consistent or guaranteed operation,

as the /cancel request depends on actions taken by the user in the app.

If the

PUT:/ecomm/v2/payments/{orderId}/cancel

request is successful, the payment state in the response will be: CANCELLED.

Warning The

GET:/ecomm/v2/payments/{orderId}/detailsendpoint however will returnCANCEL, notCANCELLED.

A call to

GET:/ecomm/v2/payments/{orderId}/details

for the same order will return the following, regardless of whether the

transaction has been reserved before the cancellation: CANCEL.

Note If the order is in the state

RESERVEDand then cancelled by the merchant, the status will beVOID.

Please note: If the user is already in a 3-D Secure session, the payment cannot be cancelled as described above.

Cancelling a partially captured order

If you wish to cancel an order that you have partially captured, send a

PUT:/ecomm/v2/payments/{orderId}/cancel

request with shouldReleaseRemainingFunds: true in the body.

The payment must be RESERVED for this to take effect.

If shouldReleaseRemainingFunds is not set, it will default to false.

When shouldReleaseRemainingFunds is set to false,

any request to cancel after a partial or full capture has been performed will be rejected.

This is a useful and recommended feature, as it releases any reserved balance as soon as the card issuer and/or bank permits.

See also the FAQ: How long does it take from a refund is made until the money is in the customer's account?

Example Request:

{

"merchantInfo": {

"merchantSerialNumber": "123456"

},

"transaction": {

"transactionText": "No socks for you!"

},

"shouldReleaseRemainingFunds": true

}

Response:

{

"orderId": "acme-shop-123-order123abc",

"transactionInfo": {

"amount": 20000,

"transactionText": "No socks for you!",

"status": "Cancelled",

"transactionId": "5001420063",

"timeStamp": "2018-11-14T15:31:10.004Z"

},

"transactionSummary": {

"capturedAmount": 10000,

"remainingAmountToCapture": 0,

"refundedAmount": 0,

"remainingAmountToRefund": 10000

}

}

Please note: Once this operation has been performed, there will be zero funds remaining to capture. Do not call this endpoint until you are sure you have captured all you need.

Refund

The merchant can initiate a refund of the captured amount. The refund can be a partial or full.

Partial refunds are done by specifying an amount which is lower than the

captured amount. The refunded amount cannot be larger than the captured amount.

In a capture request, the merchant may also use the X-Request-Id header. See Idempotency for details.

Refunds can be made up to 365 days after reservation.

Attempting to refund an older payment will result in a

HTTP 400 Bad Request.

Example Request:

POST:/ecomm/v2/payments/acme-shop-123-order123abc/refund

{

"merchantInfo": {

"merchantSerialNumber": "123456"

},

"transaction": {

"amount": 20000,

"transactionText": "Refund of Vipps socks"

}

}

Response:

{

"orderId": "acme-shop-123-order123abc",

"transaction": {

"amount": 20000,

"transactionText": "Refund of Vipps socks",

"status": "Refund",

"transactionId": "5600727726",

"timeStamp": "2018-11-14T15:23:02.286"

},

"transactionSummary": {

"capturedAmount": 20000,

"remainingAmountToCapture": 0,

"refundedAmount": 20000,

"remainingAmountToRefund": 0

}

}

See FAQ: Refunds for common questions.

Get payment details

GET:/ecomm/v2/payments/{orderId}/details retrieves the full history of a payment and the status of the operations.

Payment states

| # | From-state | To-state | Description | Operation |

|---|---|---|---|---|

| 0 | - | Initiate | Payment initiation | INITIATE |

| 1 | - | The merchant has initiated the payment | INITIATE | |

| - | The user has accepted the payment and amount has been reserved | RESERVE | ||

| - | Cancel | The user has cancelled the order | CANCEL | |

| 2 | Reserve | Capture | The merchant captures the payment and ships | CAPTURE |

| - | Cancel | The merchant has cancelled the order | VOID | |

| 3 | Capture | -- | A final state: Payment fully processed | CAPTURE |

| - | Refund | The merchant has refunded the money to the user | REFUND | |

| 4 | Cancel | -- | A final state: Payment cancelled | - |

| 5 | Refund | -- | A final state: Payment refunded | - |

Requests and responses

Please note that the response from

GET:/ecomm/v2/payments/{orderId}/details

always contains the entire history of payments for the order, not just the current status.

Important: The operationSuccess field indicates whether an operation was successful or not.

| Response | Description |

|---|---|

INITIATE | Payment initiated by merchant |

RESERVE | Payment reserved by user accepting the payment in Vipps |

CAPTURE | Payment captured by merchant (after RESERVE) |

REFUND | Payment refunded by merchant (after CAPTURE) |

CANCEL | Payment cancelled by user in Vipps |

SALE | Payment captured with direct capture by merchant |

VOID | Payment cancelled by merchant |

Example response

{

"orderId": "acme-shop-123-order123abc",

"transactionSummary": {

"capturedAmount": 20000,

"remainingAmountToCapture": 0,

"refundedAmount": 20000,

"remainingAmountToRefund": 0,

"bankIdentificationNumber": 492560

},

"transactionLogHistory": [

{

"amount": 20000,

"transactionText": "Refund of Vipps socks",

"transactionId": "5600727726",

"timeStamp": "2018-11-14T15:23:02.286Z",

"operation": "REFUND",

"requestId": "1542208972",

"operationSuccess": true

},

{

"amount": 20000,

"transactionText": "One pair of Vipps socks",

"transactionId": "5001420058",

"timeStamp": "2018-11-14T15:22:46.680Z",

"operation": "CAPTURE",

"requestId": "1542208966",

"operationSuccess": true

},

{

"amount": 20000,

"transactionText": "One pair of Vipps socks",

"transactionId": "5001420062",

"timeStamp": "2018-11-14T15:21:22.126Z",

"operation": "RESERVE",

"requestId": "",

"operationSuccess": true

},

{

"amount": 20000,

"transactionText": "One pair of Vipps socks",

"transactionId": "5001420062",

"timeStamp": "2018-11-14T15:21:04.697Z",

"operation": "INITIATE",

"requestId": "",

"operationSuccess": true

}

]

}

Please note:

- The

transactionSummarywill not be part of the response if the user does not react to the landing page or app-switch. - The

bankIdentificationNumberwill only be part oftransactionSummaryin the response of theGET:/ecomm/v2/payments/{orderId}/detailsendpoint. - If paymentType is set to

eComm Express Paymentyou will getshippingDetailsanduserDetailsin addition totransactionLogHistoryandtransactionSummary. - If you initiate the payment with a

scopeto use with the Userinfo API you will also get auserDetailsobject containing the user's information:

"userDetails": {

"bankIdVerified": 0,

"email": "user@example.com",

"firstName": "Ada",

"lastName": "Lovelace",

"mobileNumber": "91234567",

"userId": "c06c4afe-d9e1-4c5d-939a-177d752a0944"

}

Polling guidelines

See Polling guidelines in the Common topics.

Get payment status

IMPORTANT: This endpoint is deprecated. Use Get payment details.

Userinfo

Vipps offers the possibility for merchants to ask for the user's profile information as part of the payment flow. This is also called "Profile Sharing".

To enable the possibility to fetch profile information for a user, the merchant can add a scope

parameter to the initiate call:

POST:/ecomm/v2/payments.

See

Userinfo API guide.

Userinfo call-by-call guide

Scenario: You want to complete a payment and get the name and phone number of a customer. Details about each step are described in the sections below.

- Retrieve the access token:

POST:/accesstoken/get. - Add scope to the transaction object and include the scope you wish to get

access to (valid scope) before calling

POST:/ecomm/v2/paymentsInclude the scopes you need access to (e.g., "name address email phoneNumber birthDate"), separated by spaces. - The user consents to the information sharing and perform the payment in Vipps.

- Retrieve the

subby callingGET:/ecomm/v2/payments/{orderId}/details - Using the sub from step 4, call

GET:/vipps-userinfo-api/userinfo/{sub}to retrieve the user's information.

An example similar to this, but with ePayment, is shown in the Userinfo quick start guide.

Please note: The sub is added asynchronously, so if the /details request

is made within (milli)seconds of the payment approval in the app, it may not be

available. If that happens, simply make another /details request.

See

Polling guidelines

in the Common topics for more recommendations.

Get userinfo

Once the user completes the session, a unique identifier sub can be retrieved from the

GET:/ecomm/v2/payments/{orderId}/details endpoint.

Example sub format:

"sub": "c06c4afe-d9e1-4c5d-939a-177d752a0944",

This sub is a link between the merchant and the user and can be used to retrieve

the user's details from Vipps userinfo:

GET:/vipps-userinfo-api/userinfo/{sub}

See: Userinfo API.

HTTP response codes

This API returns the following HTTP statuses in the responses:

200 OK201 Created204 No Content400 Bad Request401 Unauthorized403 Forbidden404 Not Found409 Conflict429 Too Many Requests500 Server Error

For more information about the HTTP response codes and JSON object in the responses, see HTTP response codes in the Common topics.

For details about the specific eCom errors and responses, see:

Rate limiting

We have added rate limiting to our APIs (HTTP 429 Too Many Requests) to prevent fraudulent and wrongful behavior, and to increase the stability and security of our APIs. The limits should not affect normal behavior, but please contact us if you notice any unexpected behavior.

The "Key" column specifies what we consider to be the unique identifier, and what we "use to count". The limits are of course not total limits.

| API | Limit | Key | Explanation |

|---|---|---|---|

| Initiate | 2 per minute | orderId + MSN | Two calls per minute per unique orderId |

| Cancel | 5 per minute | orderId + MSN | Five calls per minute per unique orderId |

| Capture | 5 per minute | orderId + MSN | Five calls per minute per unique orderId |

| Refund | 5 per minute | orderId + MSN | Five calls per minute per unique orderId |

| 120 per minute | orderId + subscription key | 120 calls per minute per unique orderId | |

| Details | 120 per minute | orderId + subscription key | 120 calls per minute per unique orderId |

Please note: The "Key" column is important. The above means that we allow two

Initiate

calls per minute per unique orderId for that MSN. This

is to prevent too many initiate calls for the same payment. The overall limit

for number of different payments is far higher than 2. The same goes for

Capture:

You can make five capture calls per minute for

one unique orderId, and the limit for capture calls for different orderId values

is far higher.

Partner keys

In addition to the normal Authentication, we offer partner keys which let a partner make API calls on behalf of a merchant.

See: Partner keys.

Idempotency

In a capture request, the merchant may also use the X-Request-Id header.

This header is an idempotency header ensuring that, if the merchant retries

a request with the same X-Request-Id, the retried request will not make

additional changes.

See the Idempotency header for more details.

Example Request:

POST:/ecomm/v2/payments/acme-shop-123-order123abc/capture

{

"merchantInfo": {

"merchantSerialNumber": "123456"

},

"transaction": {

"amount": 20000,

"transactionText": "Socks on the way! Tracking code: abc-tracking-123"

}

}

Response:

{

"orderId": "acme-shop-123-order123abc",

"transactionInfo": {

"amount": 20000,

"timeStamp": "2018-11-14T15:22:46.736Z",

"transactionText": "Socks on the way! Tracking code: abc-tracking-123",

"status": "Captured",

"transactionId": "5001420058"

},

"transactionSummary": {

"capturedAmount": 20000,

"remainingAmountToCapture": 0,

"refundedAmount": 0,

"remainingAmountToRefund": 20000

}

}

Exception handling

The section below explains how Vipps handles different exception and errors.

See also Errors.

Connection timeout

Defining a socket timeout period is the common measure to protect server resources and is expected. However, the time needed to fulfil a service requests depends on several systems, which impose longer timeout period than usually required.

We recommend setting no less than 1 second socket connection timeout and 5 seconds socket read timeout while communicating with Vipps.

A good practice is, if/when the socket read timeout occurs, to call

GET:/ecomm/v2/payments/{orderId}/details

and check status of last transaction in transaction history prior

to executing the service call again.

Callback aborted or interrupted

If the communication is broken during payment process for some reason, either because of network problems, that the user abruptly closes the app or something else, and Vipps is not able to execute callback, the callback will not be retried.

In other words, if the merchant doesn’t receive any confirmation on payment

request call within callback time frame, merchant must call

GET:/ecomm/v2/payments/{orderId}/details

to get the response of payment request.

PSP connection issues

In cases of communication problems with Vipps' PSP, the response from Vipps will be an error (see Errors).

The merchant should then call

GET:/ecomm/v2/payments/{orderId}/details

to check if the transaction request is processed before making a new call,

using same idempotency key (see Idempotency).

Clean-up strategies

Vipps recommends merchants implement a robust clean up strategy for all orders where the goods or services are not issued to the user.

An example case would be:

Bank X is having issues and transactions for their customers are slow (15+ seconds) for a significant period of time. As a result of this the user decides to close the Vipps app while the transaction is being processed, they do not then see the final result in the Vipps app. This transaction will eventually result in a successful reservation. The user then returns to the Merchants app, but as the entry was not via an expected app-switch from the Vipps app, state is not correctly resumed. The user attempts a second payment, which this time goes through in a timely manner, and upon app-switch back the user is issued their goods/services.

The user has now two reservations and only received goods/services once. It is the merchant's responsibility here to ensure the first order, for which no goods/services were issued, should be cancelled to remove the reservation from the customers account.

Vipps recommends polling

GET:/ecomm/v2/payments/{orderId}/details

until either a REJECT, USER_CANCEL, RESERVE or SALE status is received,

and then performing the appropriate action based on the status of product issuing.

The user should also be notified that the merchant has issued any product to

ensure they do not naturally retry the purchase. This includes using SMS/email

strategy if it is unclear that the user in on the merchant's website/app to see confirmation.

Recommendations for handling very high traffic

At peak traffic, like Black Friday, it is especially important to have a robust integration.

We strongly recommend using "reserve capture", and not "direct capture", so it is possible to cancel a payment without making a refund.

- Make sure you poll

GET:/ecomm/v2/payments/{orderId}/details, and do not rely on the callback from Vipps, and also don't rely on the user reaching the callback URL. - Consider if you should cancel or complete the payment if the payment takes

much longer than normal, so much that the user may give up.

- If you sell a ticket: It may be good to always issue the ticket if the user has approved the payment, even if the processing of the payment takes much longer than normal and the user "gives up".

- If you sell food at a restaurant: If the payment takes so long that the user gives up and tries to order again: It may be smart to cancel the previous order, even though the user did approve the payment.

It is also important that the merchant's and/or partner's systems are able to handle the peak traffic.

See also:

App integration

Merchants may implement deep-linking, to trigger Vipps (we refer to this as "app-switch" here).

This may be done in two ways:

- From a mobile or desktop browser. See Desktop flow

- From an iOS or Android native app

After the user has finished (or cancelled) the payment in Vipps, the user is returned to the specified fallBack URL. When the user arrives back in the merchant app or website, we strongly recommend that you perform a call to the payment details endpoint to check the state

of the transaction. While some state of the eCom operation can be derived from things like whether or not user returned successfully from the

Vipps app, the most reliable approach to know the state of the payment is always to query the eCom API once the user arrive back in the merchant app/website.

App-switching

- The merchant need to pass the URL scheme of the app into the

fallBackfield in the initiate payment request. See App-switch on iOS and App-switch on Android for specifics. - The merchant app should open Vipps deeplink received from the initiate payment request.

- Once the operation in Vipps is completed, Vipps will redirect the user to the deeplink specified in the

fallBackfield. - The merchant app should query the payment details endpoint for updated status on the payment once user returns from Vipps.

Please note: Vipps will append a status at the end of the fallback URL. For example, if your fallBack URL is merchantApp://result?myAppData, Vipps

will append the status like: merchantApp://result?myAppData&status=301 or merchantApp://result?myAppData&status=100. This status is deprecated, and should no longer be used. Query the payment details endpoint for latest status instead.

App-switch on iOS

Vipps on iOS requires a URL scheme in order to support app-switch.

See the official Apple documentation: Defining a Custom URL Scheme for Your App

Switch from merchant app to Vipps

Below is sample code to open iOS Vipps application with deeplinkURL.

NSString *url = deeplinkURL; // Use the deeplinkURL provided in the API response

if ([[UIApplication sharedApplication] canOpenURL:[NSURL URLWithString:url]]) {

[[UIApplication sharedApplication] openURL:[NSURL URLWithString:url]]; }

else {

// No Vipps app installed: Open app store page.

// Once user installs Vipps, calling app needs to initiate deeplinking again in order to get the callback

[[UIApplication sharedApplication] openURL:[NSURL URLWithString: @"https://itunes.apple.com/no/app/Vipps-by-dnb/id984380185"]];

}

Example of a deeplinkURL:

vipps://?token=eyJraWQiOiJqd3RrZXkiLCJhbGciOiJSUzI1NiJ9.ey <snip>

Please note: For production it's vipps://, but for our test environment it's vippsMT://.

Redirect back to the merchant app from Vipps app

Once the operation in Vipps is completed, Vipps will open the fallback URL.

For app-to-app integration, merchant app needs to be registered for a URL scheme

and pass the URL scheme in fallBack URL in the Vipps backend API.

The Vipps mobile application will use the URL to launch the merchant application.

App-switch on Android

Vipps is launched with a standard intent, using the URL returned from the eCom API when the payment is created ("url": "vipps://?token=eyJraWQiOiJqd3RrZXki..")

Switching from merchant app to Vipps

Example of how to open Vipps:

package com.example.app

import android.app.Activity

import android.content.Intent

import android.content.pm.PackageManager

import android.net.Uri

class MyActivity : Activity() {

companion object {

const val vippsPackageName = "no.dnb.vipps"

const val vippsRequestCode: Int = TODO("insert your own custom identifier for tracking vipps app intents")

}

// use deeplinkUrl from ecom response payload

fun openVippsApp(deeplinkUrl: String) {

try {

val pm = applicationContext.packageManager

val packageInfo = pm.getPackageInfo(vippsPackageName, PackageManager.GET_ACTIVITIES)

val intent = Intent(Intent.ACTION_VIEW, Uri.parse(deeplinkUrl))

startActivityForResult(intent, vippsRequestCode)

} catch (e: PackageManager.NameNotFoundException) {

// No Vipps app installed! Open the Vipps page on Google Play

val playStoreUrl = "https://play.google.com/store/apps/details?id=$vippsPackageName"

val intent = Intent(Intent.ACTION_VIEW).setData(Uri.parse(playStoreUrl))

startActivity(intent)

}

}

}

Switching back to the merchant app from Vipps app

Once the user has paid (or cancelled), Vipps supports two ways to return to the merchant native app:

1: Let Vipps deeplink back into the merchant app using their URL scheme (e.g., merchantapp://). This is the default/suggested approach.

2: Just close Vipps, fall back to the merchant app, pick up the thread again there in onActivityResult().

In both cases, the merchant app should query the eCom API for updated status on the payment once user returns from Vipps.

Return to merchant app by actively deeplinking into it from Vipps

With this approach, the merchant app has to have its own URL scheme registered so Vipps can actively open the merchant app again after payment/cancellation.

In the example below, MainActivity is the receiving activity and Vipps opens it once the payment is done.

To receive a call back from Vipps to an activity, a filter has to be set for that activity. In the merchant app, set a filter in the Manifest file:

<activity android:name=".MainActivity" android:label="@string/app_name" android:launchMode="singleInstance">

<intent-filter>

<action android:name="android.intent.action.VIEW" />

<category android:name="android.intent.category.DEFAULT" />

<category android:name="android.intent.category.BROWSABLE" />

<data android:scheme="sampleApps" />

</intent-filter>

</activity>

Please note: The scheme should be same specified in fallBack URL sent to the eCom API when the payment is created.

The Vipps application will send the result to the merchant app by

starting a new activity with the fallBack URL as a URL parameter in the intent.

The merchant app can make their receiving activity a singleInstance

to handle the response in same activity.

The receiving MainActivity has to override the onNewIntent method to handle

result send by Vipps:

override fun onNewIntent(intent: Intent) {

// Call the eCom API, check the status of the eCom payment

}

Redirect back to merchant app by simply closing Vipps

With this approach, the merchant app does not have to register/handle deeplink URLs.

In order to use this approach, when creating the payment in the merchant has to pass fallback attribute like this:

"fallBack": "INTENT"

(and only "INTENT", no parameters etc.)

This will cause Vipps to simply close after a successful or cancelled eCom payment, and fall back to the calling merchant app.

The merchant app activity that resumes again (after Vipps closes) has to override onActivityResult method to pick up the thread again here. Example:

override fun onActivityResult(requestCode: Int, resultCode: Int, data: Intent) {

// Call the eCom API, check the status of the eCom payment

}

Errors

Error object in the response

See HTTP response codes.

[

{

"errorGroup": "Payment",

"errorMessage": "Refused by issuer because of expired card",

"errorCode": "44"

}

]

{

"statusCode": 401,

"message": "Access denied due to invalid subscription key. Make sure to provide a valid key for an active subscription."

}

Error groups

| Error groups | Description |

|---|---|

| Authentication | Authentication Failure because of wrong credentials provided |

| Payment | Failure while doing a payment authorization |

| InvalidRequest | Request contains invalid parameters |

| VippsError | Internal Vipps application error |

| User | Error related to the Vipps user (Example: Not a Vipps user) |

| Merchant | Errors regarding the merchant |

Error codes

Please note: Vipps is only allowed to provide all of these errors through

the API, and that we have to send VippsError (99) in cases where we are not

allowed to provide more details. The same goes for errors from our PSP: We

may not be allowed to pass on the details to merchants.

In case of errors: Use Get payment details to retrieve all the information about the payment.

| Error group | Error Code | Error Message (and some explaining text for some errors) |

|---|---|---|

| Payment | 41 | "The user does not have a valid card." The customer must add a card. |

| Payment | 42 | "Refused by the issuer." The customer must contact the issuer, typically the bank. |

| Payment | 43 | "Refused by the issuer: Invalid amount." |

| Payment | 44 | "Refused by the issuer: Expired card." The customer must add a card. |

| Payment | 45 | "Reservation failed, reason unknown." Most common: The customer has not acted upon the payment. We can not know the reason for this. See Timeouts. |

| Payment | 51 | "Cannot cancel an orderId that has already been captured." Cannot cancel, do a refund instead. |

| Payment | 52 | "Cancellation failed, reason unknown." Cancel failed. |

| Payment | 61 | "The total capture amount exceeds the reserved amount. You cannot capture a higher amount than the user has accepted. Check the payment details". This is in rare cases caused by rounding errors on the merchant's side. Check the payment details. |

| Payment | 62 | "The amount you tried to capture is not reserved. The user must accept the payment before capture can be done." |

| Payment | 63 | "Capture failed an unknown reason. Retrieve the payment details to see the full details." Use payment details to see the exact status. |

| Payment | 71 | "Cannot refund a higher amount than the captured amount." This is in rare cases caused by rounding errors on the merchant's side. |

| Payment | 72 | "Cannot refund a reserved order. The orderId can be canceled instead." Cancel instead. |

| Payment | 73 | "Cannot refund a canceled order." |

| Payment | 74 | "Refund failed during debit from the merchant's account." |

| Payment | 93 | Captured amount must be the same in an idempotent retry. The same Idempotency-Key can not be used with different request payloads. |

| Payment | 95 | "Payments can only be refunded up to 365 days after reservation. See the FAQ." or "Direct capture is not allowed. See the Checkout documentation." See Reserve and capture. |

| Payment | 98 | "Payments can only be captured up to 180 days after reservation. See the FAQ." Payments can only be captured up to 180 days after reservation. See Reserve and capture. |

| Payment | 1082 | This person is not BankID verified. This only applies for test users. |

| VippsError | 91 | "The transaction is not allowed." Typically shown when attempting to capture a cancelled order. |

| VippsError | 92 | "The transaction has already been processed." |

| VippsError | 93 | "The capture request must be identical to the previous request(s) in an idempotent retry." or "The refund request must be identical to the previous request(s) in an idempotent retry." |

| VippsError | 94 | Order locked and is already processing. This can occur for a short period of time if a bank has problems, and Vipps needs to wait and/or clean up. Retry the same request later, with the same idempotency key. |

| VippsError | 98 | "Too many concurrent requests. See the FAQ." Used only to prevent obviously incorrect API use. See Rate limiting. |

| VippsError | 99 | "Internal error. In some cases, this is caused by an incorrect API request. Please check the request." In practice this is always due to a combination of a bad request from the merchant and inadequate validation at our end. See Why do I get HTTP 500 Internal Server Error?. |

| user | 81 | "The phone number is either incorrectly formatted (see the API specification), is not a Vipps user, or the user cannot pay businesses. Vipps cannot give more details." We can not give all the details, as we can not reveal if the user is blocked, is too young to pay businesses, etc. |

| user | 82 | "The user's app version is not supported." The user must upgrade the app. |

| Merchant | 31 | "The merchant is blocked. The merchant can contact customer service for details." We can not reveal the details. See Why do I get errorCode 37 "Merchant not available or deactivated or blocked"?. |

| Merchant | 32 | "The receiving limit of merchant is exceeded." The merchant has received more money than allowed. The merchant can contact customer service for details. |

| Merchant | 33 | "The merchant's payment request limit is exceeded." The merchant has requested more money than allowed. can contact customer service for details. |

| Merchant | 34 | "Duplicate orderId. The orderId must be unique for each MSN. It has already been used for this MSN." The orderId has already been used for another payment for this MSN. The orderId must be unique for the MSN. Follow the orderId recommendations. |

| Merchant | 35 | "The orderId 'acme-shop-123-order123abc' does not exist for MSN 654321." Follow the orderId recommendations. |

| Merchant | 36 | "The merchant's agreement has not been signed." The merchant can contact customer service for details. |

| Merchant | 37 | "The merchant and/or sales unit is unavailable, deleted, deactivated or blocked for payments." We can not reveal the details. See Why do I get errorCode 37 "Merchant not available or deactivated or blocked"? |

| Merchant | 38 | "The sales unit is not allowed to skip the landing page. See the FAQ." See the landing page. |

| Merchant | 39 | "The sales unit is not allowed to initiate long-living payments." |

| Merchant | 97 | "The sales unit is not allowed to perform payments. See the FAQ." Typically shown for a merchant that has only applied for Login API, and has not been through the required compliance checks for making payments. See Why do I get "Merchant Not Allowed for Ecommerce Payment"?. |

| InvalidRequest | - | The field name will be the error code. Contains a description about what exactly the field error is. |

Testing

To facilitate automated testing in

The Vipps Test Environment (MT)

the Vipps eCom API provides a "force approve" endpoint to avoid manual

payment confirmation in the Vipps app:

POST:/ecomm/v2/integration-test/payments/{orderId}/approve

The "force approve" endpoint allows developers to approve a payment through the Vipps eCom API without the use of Vipps. This is useful for automated testing. The endpoint is only available in our test environment.

Important: All test users must manually approve at least one payment in Vipps (using the app) before "force approve" can be used for that user. If this has not been done, you will get an error. This is because the user needs to be registered as "BankID verified" in the backend, and this happens automatically in the test environment when using Vipps (the app), but not with "force approve".

Please note: Vipps Hurtigkasse (express checkout) and skipLandingPage is

not supported by the force approve endpoint.

Recommendations regarding handling redirects

See Common topics: Recommendations regarding handling redirects.