Settlements

Overview

Merchants using Vipps will receive the money in bulk payments, usually one per day. In these, bulk payment we have summed together all payments for the day, subtracting refunds and fees to Vipps. It is therefore necessary to download reports that explain the bulk payment, so that it can be correctly filed in the merchant's accounting system. Such reports can be fetched either in the portal or by using the Report API.

Usually, you will wish to implement a reconciliation process, where you download a report from Vipps each day, and check that contents of the report match the data you have on your own side. We recommended that you do this by matching per transaction on transaction IDs.

This guide will focus on using the Report API, but may also be useful reading for those who rely on using reports from the portal for their reconciliation processes.

See Common topics: Settlements for details about settlements, in general.

Ledgers

Vipps settlements work in the same way for all Vipps payment products; whether one is using Vippsnummer or one of the Vipps APIs.

Vipps does not transfer money to/from the merchant for every payment made. Instead, all transactions are put on a ledger that track the funds that Vipps owes the merchant. During the day transactions occur that usually increase, and sometimes decrease, the balance the merchant has in Vipps and thus the ledger balance. Periodically, usually daily, the balance of the ledger is paid out to a configured account number and the balance is reset.

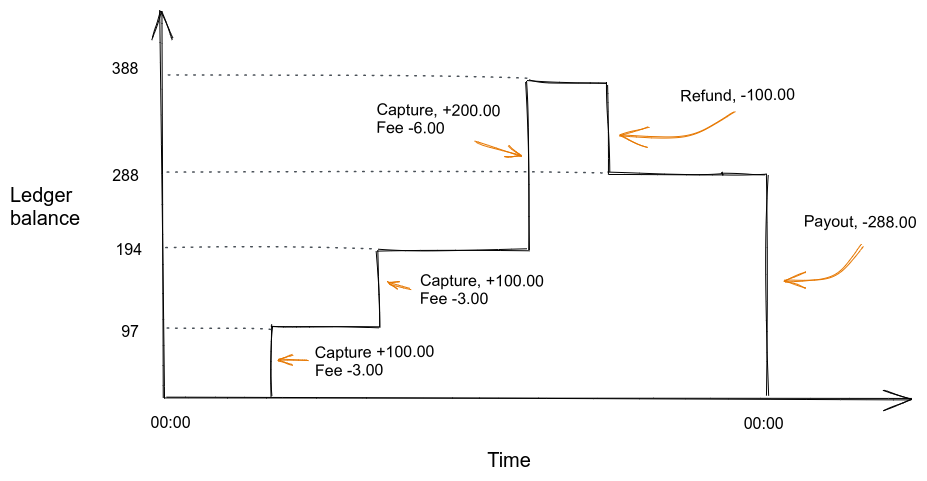

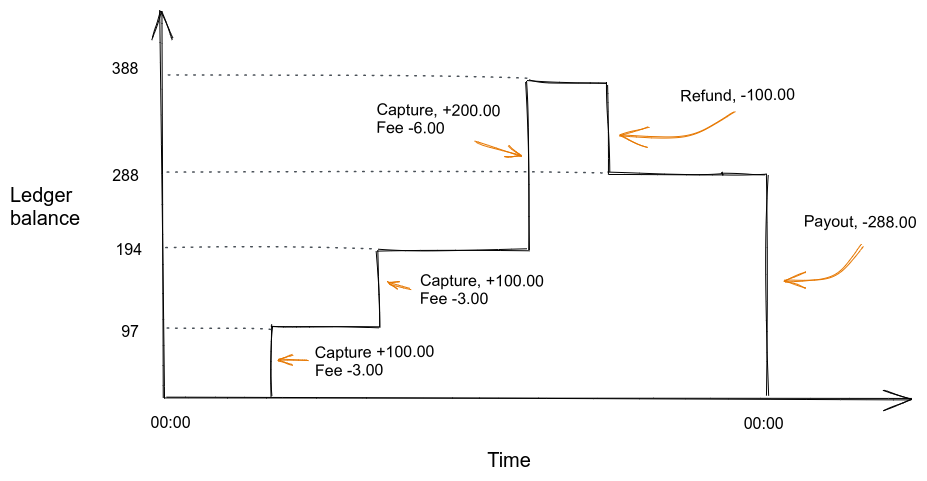

The following illustration shows an example day at a low-traffic merchant.

Captures and refunds (described in further detail below) are added to the

ledger, changing the balance of funds that Vipps owes the merchant. In the end,

the balance is paid out. The payout is itself a transaction on the ledger,

adjusting the balance down to zero.

For the large majority of merchants, there is a direct correspondence between a Vippsnummer or e-com Merchant Serial Number (MSNs) to a ledger:

However, for merchants who require it, Vipps has limited support for multiple Vippsnummer and eCom MSNs to be settled together. The payments to multiple different units are then combined in a single settlement payout:

The ledger has its own ledgerId, so the first step in using the report API is

to fetch the list of ledgers you have access to. If you are integrating a single

merchant it may be enough to hit this endpoint once manually to identify

the ledgerId. An example response from

GET:/settlement/v1/ledgers

is:

{

"items": [

{

"ledgerId": "302321",

"currency": "NOK",

"payoutBankAccount": {

"scheme": "BBAN:NO",

"id": "86011117947"

},

"firstPayout": "2000001",

"lastPayout": "2000045",

"owner": {

"scheme": "business:NO:ORG",

"id": "987654321"

},

"settlesForRecipientHandles": [ "api:123455" ]

}

],

"cursor": ""

}

A Vippsnummer will use the same settlesForRecipientHandles structure, but have a different prefix:

{

"settlesForRecipientHandles": [ "NO:123455" ]

}

If you only want to look up the ledgerId from an MSN or Vippsnummer, you

may use the settlesForRecipientHandles argument to filter the response.

If you are integrating an accounting system for many customers, it can be relevant to poll this endpoint many times as you will continue to see new ledgers appear for different customers as they grant your accounting system access to their data.

Transaction types

Capture transactions

Captures represent money being transferred from the customer, through Vipps, to the merchant. Captures increase the ledger balance. The captures are indicated by a gross amount and a fee to Vipps for the service provided; the balance is typically increased by the gross amount less the fee (net settlement).

In exceptional cases, Vipps can configure gross settlements. In this case, the fees are not deducted from the ledger balance, but are instead invoiced at the end of the month.

In some of the other APIs we distinguish between two types of payment flows: The "sale" flow for an immediate purchase, and "reserve/capture" flow for where one first receives a reservation, and then capture it fully or partially at a later point. In the settlement process we use capture for both cases for a transfer from the customer to the merchant through Vipps. Reservations are not relevant to the settlement process.

Refund transactions

Refunds represent transfers in the other direction. These are initiated by the merchant; either by using the API or through portal.vipps.no. Refunds are always deducted from the next settlement payout, also if you have a gross settlement setup. Currently, refunds always have zero fees.

Payout transactions

Payouts represent a transfer from the merchant's ledger, sitting in Vipps' bank accounts, to the bank account of the merchant. Since the money goes out of the ledger, and to the merchant's bank account, the payout transaction has a negative amount in the figure above.

With the typical daily settlement setup, there will be a payout transaction generated every midnight for the full balance on the ledger. There are however exceptions to this:

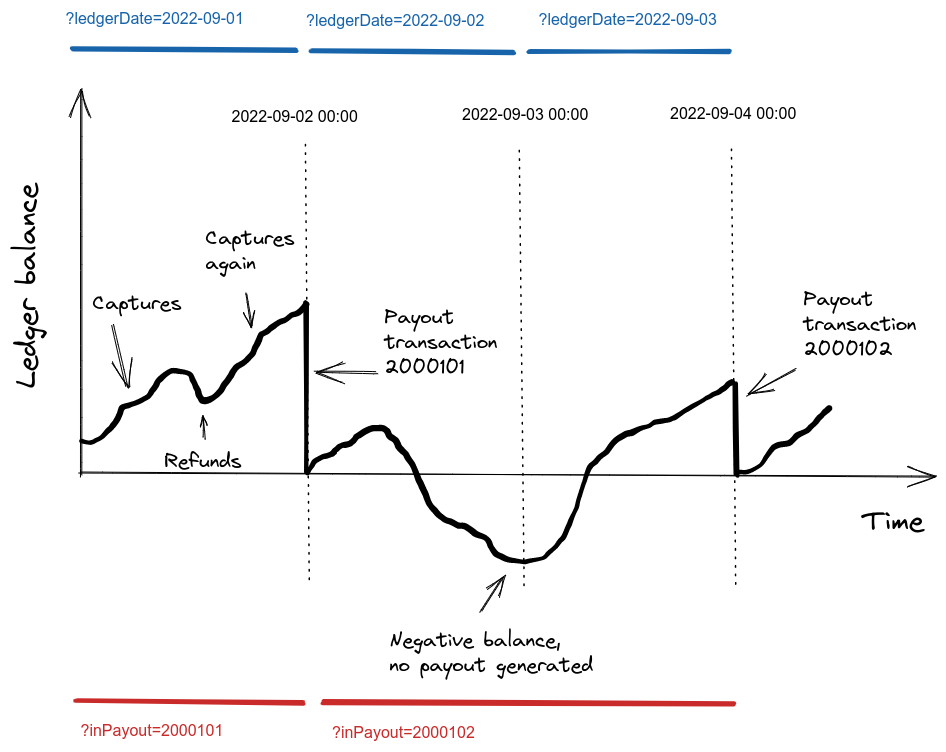

Sometimes the ledger balance becomes negative, because the sum of refunds exceeds the sum of captures minus the sum of fees. In these cases there is nothing to pay out and the payout transaction will not be generated. The merchant is loaning money from Vipps in order to refund the customer. Once the ledger balance is positive again the loan has been repaid and payouts resume. An example is shown in the figure further down on this page.

It is possible to configure a Ledger to generate payouts on a weekly or monthly basis. This is mainly done by merchants with low volume who want to save the accounting overhead of booking a payout every day.

Depending on the specific merchant, Vipps may require that some money is left on the ledger in case of future refunds or chargebacks. It should therefore not be assumed that the balance on the ledger is zero after a payout.

Vipps may in general block payouts from a given ledger due to special agreements with the merchant in order to mitigate risk, suspicion of fraud, etc.

The presence of a payout transaction on the ledger simply indicates a decision to pay the money out. There is a two-day delay in the bank transfer process itself:

Day 1: A sale or capture happens. Since a merchant should not capture the amount, i.e. charge the customer, until the purchased product is shipped, the "day 1" is normally the day that the product is shipped and the customer's account is charged.

Day 2: The payout transaction is generated during the night, and the payout transaction becomes visible on the ledger. The timestamp is set to midnight at the start of the day.

Day 3: The actual bank transfer for the payout is made from Vipps' bank account to the merchant's bank account. Money is normally available in the account before noon.

Days are bank days, Monday - Friday, excluding banking holidays. In other words, a capture made on Monday will be on merchant's account on Wednesday, while a capture made on Friday will be on merchant's account on Tuesday.

The payout will be marked with the text Utbet. 2000101 Vippsnr <ledgername>.

In the future, we plan to add a

GET:/report/v1/payouts

endpoint to the API that provides more information about the status of a payout.

Other transactions

Users of this API has to account for the possibility of more transaction types than just capture and refunds. Likely examples in the future are invoices, chargebacks, manual adjustments, and weekly or monthly fees. The reference documentation has more details about transaction types.

Reports

To perform reconciliation you download a report that lists the transactions

that has happened on a specific ledger. To continue with our simple example from

above:

One can request a report from this ledger by

calling

GET:/report/v1/ledgertransactions?ledgerId={ledgerId},

for instance:

GET https://api.vipps.no/report/v1/ledgertransactions?ledgerId=302321&ledgerDate=2022-10-01

An example JSON response for the call above that matches the illustration above:

{

"cursor": "",

"items": [

{

"transactionId": "3343121302",

"timestamp": "2022-10-01T16:33:00.824993+0200",

"ledgerDate": "2022-10-01",

"ledgerId": "302321",

"transactionType": "capture",

"orderId": "purchase-12",

"currency": "NOK",

"ledgerAmount": 7.89,

"grossAmount": 9,

"fee": 1.11,

"recipientHandle": "nor:57860"

},

{

"transactionId": "2370000000",

"timestamp": "2022-10-01T18:37:55.982497+0200",

"ledgerDate": "2022-10-01",

"ledgerId": "302321",

"transactionType": "refund",

"orderId": "purchase-12",

"currency": "NOK",

"ledgerAmount": -6,

"grossAmount": -6,

"fee": 0,

"recipientHandle": "nor:57860"

},

{

"transactionId": "1000002731792000009",

"timestamp": "2022-10-01T22:00:00.000000+0200",

"ledgerDate": "2022-10-01",

"ledgerId": "273179",

"transactionType": "payout",

"orderId": null,

"currency": "NOK",

"ledgerAmount": -1.89,

"grossAmount": -1.89,

"fee": 0.00,

"recipientHandle": null

}

]

}

Formatted as a table:

| transactionId | transactionType | reference | ledgerDate | ledgerAmount | grossAmount | fee | recipientHandle | time |

|---|---|---|---|---|---|---|---|---|

| 3343121302 | capture | purchase-12 | 2022-10-01 | 7.89 | 9 | 1.11 | nor:57860 | 2022-10-01T16:33:00.824993+0200 |

| 2370000000 | refund | purchase-12 | 2022-10-01 | -6 | -6 | 0 | nor:57860 | 2022-10-01T18:37:55.982497+0200 |

| 1000002731792000009 | payout | 2000045 | 2022-10-01 | -1.89 | -1.89 | 0.00 | 2022-10-01T22:00:00.000000+0200 |

Some notes:

- You should be prepared to receive a new transactionType that you do not already know about.

- ledgerAmount is always the contribution the transaction has to the ledger

balance. This means that if you are set up with gross settlements, it will be

equal to

grossAmount, unlike the case above. - ledgerDate is the accounting date used to group transactions for payouts. In

the future it may be possible to set this to something else than midnight

local time, and in that case this will deviate from

time. - The payout transaction does not have a

recipientHandle. TherecipientHandleis not a required field, it represents metadata about a transaction. TherecipientHandlecan be either themsnor thevippsnummer.

For more details and descriptions about the individual columns, please consult the OpenAPI Spec.

Please note: Data is not available in the API until some time after

the ledgerDate has ended. This is primarily because Vipps in some

cases compute fees based on the volume throughout the entire day,

so that the fee and ledgerAmount can not be computed before the day

has ended.

Periodization

The

GET:/report/v1/ledgertransactions?ledgerId={ledgerId}

endpoint has several parameters for selecting a range of

transactions to return, which can be used for an initial data import.

Most users of the API will want to set up an automated job to call

the

GET:/report/v1/ledgertransactions?ledgerId={ledgerId}

endpoint on a daily basis to download the data for the

preceding day. Such synchronization can be done in two ways: Date-based indexing

and payout-based indexing. Often they will give the same results; the difference

is:

- When weekly or daily settlements are configured; then a payout is only generated the 1st day of the week or month

- When the balance is negative, a payout is not generated

The last scenario is depicted in the figure below. On the

time 2022-09-03 00:00:00, the balance is negative, and so no payout is

generated for ledgerDate=2022-09-02.

By fetching transactions by

?ledgerDate=, one will get one report per date. This is indicated by the blue bands on top of the figure. The advantage is that one consistently gets more data each day, also for monthly/weekly settlements and negative balance.By fetching transactions by

?inPayout=, transactions for several days may be provided in the same report. See the red bands at the bottom of the figure below. The advantage is that the sum ofledgerAmountin the report will exactly match the payout bank transfer amount.

Both modes can be useful depending on the specifics of your reconciliation

routines, but in general we recommend fetching by date, and to do reconciliation

transaction by transaction based on reference.

Using cursors

Since the amount of data that can be returned in any of the endpoints in this API can be quite large, we limit the amount of rows returned in each request to a set amount. Right now this is 1000 rows.

If the total number of rows is greater than this amount, we return a cursor in addition to the rows in the body.

This cursor value can be inserted into the URL with the parameter named cursor to fetch the next set of items.